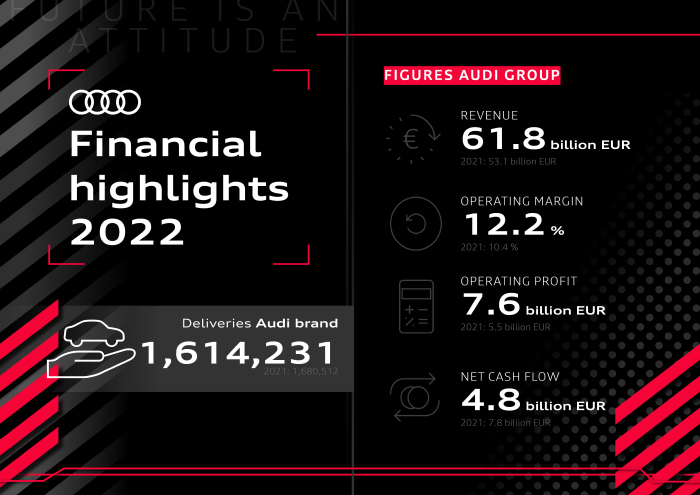

The Audi Group closed the 2022 fiscal year with a record result in a year when the company continued its path toward becoming a leading provider of connected, fully electric premium mobility. Revenue rose 16.4 percent to a record €61.8 billion while operating profit climbed nearly 40 percent to an all-time high of €7.6 billion. The operating margin rose from last year’s 10.4 percent to 12.2 percent, and net cash flow reached €4.8 billion, the second-highest figure in the company’s history. Key drivers of this year’s strong financial performance included consistent crisis management in a year marked by overlapping global challenges, a good price position, and strong results from the Bentley, Lamborghini, and Ducati brands. 2022 also saw a sharp increase in the number of fully electric models delivered.

In 2023, Audi will launch the largest product campaign in the company’s history, starting with the future Q6 e-tron model series. It will be the first electric model based on the Premium Platform Electric (PPE).

“Our Vorsprung 2030 strategy provides the right answers, even in times of multiple crises,” says Markus Duesmann, CEO of AUDI AG. “We are focusing Audi on sustainability and systematically advancing the digitalization and electrification of our products.”

Deliveries almost at previous year’s level

The Audi, Bentley, Lamborghini, and Ducati brand group1 delivered a total of 1,638,638 (2021: 1,688,9782) cars and 61,562 (2021: 59,447) motorbikes in 2022. Despite major challenges in the logistics and supply chains, particularly in the first half of the year, deliveries this reporting year remained almost on par with last year, thanks to a strong performance in the second half of the year. In 2022, the Audi brand delivered 1,614,231 (2021: 1,680,512) cars to customers.

Persistent, strong growth in electric vehicles

In 2022, the Audi Group again saw significant growth in deliveries of fully electric models. With an increase of around 44 percent in deliveries of fully electric cars (118,196 vehicles), the Premium brand group is systematically continuing its electrification strategy. The persistent, strong demand for electric vehicles means the share of fully electric vehicles delivered rose from 4.8 percent in the previous year to 7.2 percent. With the launch of the Premium Platform Electric (PPE), Audi is emphasizing its commitment to becoming the leading provider of connected, fully electric premium mobility. Developed together with Porsche, the platform is a key component for expanding Audi’s global range of electric cars. The future Q6 e-tron model series, the Group’s first production model to be based on the PPE, will be unveiled in the second half of 2023.

“With the Audi Q6 e-tron, e-mobility is coming from Ingolstadt for the first time,” says Audi CEO

Duesmann. “To this end, we’re also building a dedicated battery assembly facility on site. This

will enable us to retain important know-how here in Germany and train our employees in future fields.”

Record-level revenue

Audi Group’s revenue rose to €61,753 (2021: 53,068) million. The 16.4 percent spike is due in particular to the strong price position and the one-off consolidation of the Bentley brand on January 1, 2022. The fully electric Audi Q4 e-tron*, Audi e-tron GT quattro*, and Audi e-tron models made a significant contribution to the increase, as did revenue from the Audi A3 and Audi Q5 model series.

Sustainability in every corporate decision

The brand group began voluntarily reporting its EU taxonomy figures back in the 2021 fiscal year. Measured against the Audi Group’s total revenue, the share of EU-taxonomy-aligned revenue rose to €8.3 (2021: 6.8) billion, equivalent to 13.5 (2021: 12.8) percent of total revenue. This includes revenue from the sale of fully electric vehicles, with an increase of 49 percent, which marks another milestone on the Audi brand’s e-roadmap. The company is thus emphasizing the importance of the ESG sustainability criteria anchored in its Vorsprung 2030 strategy.

In order to make visible and transparent the high priority the company places on sustainable development in accordance with the ESG (environment, social, and governance), AUDI AG is currently obtaining a comprehensive ESG rating from an independent rating agency. The rating is due to be published in the spring of 2023.

In positioning itself for a sustainable future, AUDI AG is also building its automotive value chain on the basis of the circular economy. Audi aims to steadily increase the share of recycled materials in the Audi fleet over the next few years. In turn, this will enable the company to reduce its models’ environmental footprint. Direct access to secondary materials is also likely to help improve long-term supply security. Together with 15 partners from the research, recycling, and supplier sectors, the brand with the four rings launched the MaterialLoop pilot project in October 2022. The company and the project partners are investigating reusing materials from cars that have reached the end of their life cycle for the production of new vehicles; around 100 end-of-life vehicles have already been dismantled. This is just one of many circular economy projects at Audi. The Audi plants in Neckarsulm, Ingolstadt, and Győr in Hungary, as well as the Volkswagen plant in Bratislava, are already implementing the Aluminum Closed Loop.

The Audi Group is continuing to accelerate its transformation into a provider of sustainable, connected premium mobility: From 2023 to 2027, the Company will invest two-thirds of its outlays, or around €28 billion, in the future fields of electrification and digitalization. Audi CEO Duesmann: “Our focus on sustainable goals will shape our actions in the short, medium, and long term. The future investments from the current planning round confirm this clear path.”

Group operating profit at record level

Audi Group’s operating profit reached €7,550 (2021: 5,498) million, an increase of 37.3 percent. The operating margin also increased significantly to 12.2 (2021: 10.4) percent. In addition to strong market performance, the positive effects of securing raw materials contributed significantly to these record results.

In line with the company’s socially sustainable focus, the system for ensuring that employees benefit from these financial successes is also being revised. To this end, the company and the Works Council have reworked Audi’s profit-sharing scheme. This revision builds on the 2019 joint agreement Audi.Future. The emphasis is on strengthening the company pension scheme and ensuring that all employees share in the company’s profits from the first euro. In addition, the revision creates a profit-dependent collective component, which is intended to strengthen Audi’s standing as an attractive employer in the long term. Based on the revised scheme, Audi is giving employees a share of the profit for their efforts in this challenging year of 2022: For a skilled worker in the German plants, for example, the Audi profit share this year amounts to €8,510 euros (previous year: 5,670 euros).

Bentley, Lamborghini, and Ducati boast record figures

The Audi Group’s impressive results are due not least to the performance of Bentley, Lamborghini, and Ducati, all of which broke records in the 2022 fiscal year. Bentley, for example, again celebrated a new delivery record for the third time in a row: Delivering 15,174 vehicles (14,659), the British brand exceeded its previous record by 3.5 percent and also significantly increased revenue to €3,384 (2021: 2,845) million. The operating margin rose to an all-time high of 20.9 (2021: 13.7) percent, while operating profit was €708 (2021: 389) million, also significantly above the previous year’s figure.

Lamborghini delivered 9,233 (2021: 8,405) cars to customers in the past fiscal year, with sales up 21.9 percent at €2,375 (2021: 1,948) million. Lamborghini generated €614 (2021: 393) million in operating profit for an operating margin of 25.9 (2021: 20.2) percent.

Despite the very challenging supply situation, Ducati delivered 61,562 (2021: 59,447) motorbikes to customers, the highest single-year number in the brand’s history. Sales increased by 24.0 percent to €1,089 (2021: 878) million, not least due to the improved price position. Operating profit rose to €109 (2021: 61) million, while the operating margin hit 10.0 (2021: 7.0) percent.

Financial result slightly higher than previous year

The Audi Group’s financial result increased significantly in 2022 to €1,522 (2021: 1,430) million. The Audi Group’s business in China, which is reflected in this figure, contributed €1,153 (2021: 1,140) million to earnings. Earnings after taxes at the end of the year amounted to €7,116 (2021: 5,649) million.

Net cash flow: Second-highest figure in company history

The Audi Group’s net cash flow came in at €4,808 (2021: 7,757) million in 2022, a strong performance that also marks the second-highest figure in the company’s history. The decline (compared with the exceptionally high figure from the previous year) is attributable partly to the increased inventories that ensure our ability to deliver and partly to the continued disruption of logistics and supply chains. In addition, higher taxes and changes affecting holdings, such as the one-off capital contribution to Audi Formula Racing GmbH and the spin-off of sales companies within the Volkswagen Group, also had an impact on net cash flow. Furthermore, there was a year-on-year increase in investments, including those of Audi FAW NEV Company Ltd. which is fully consolidated within the Audi Group. With the new production plant for fully electric Audi models based on the PPE being built in Changchun, the Group is paving the way for the expansion of the localized fully electric product portfolio in China.

A look at the 2023 fiscal year

“Audi demonstrated great financial strength in 2022 despite challenging global conditions and broke records in revenue and operating profit,” said Audi CFO Jürgen Rittersberger. “These results give us confidence that we will continue to achieve our ambitious strategic goals going forward.”

The brand group currently foresees – subject to the supply situation and global economic performance – that the Group will continue to see positive developments in the fiscal year 2023: Deliveries of brand group models to customers are expected to be between 1.8 and 1.9 million cars, while revenue is expected to reach a new record level of between €69 billion and €72 billion. The operating margin is expected to be between 9 and 11 percent, assuming that car prices remain high. The Audi Group expects its net cash flow to be between €4.5 billion and €5.5 billion, which represents a continuation of its strong performance.

COMMENTS