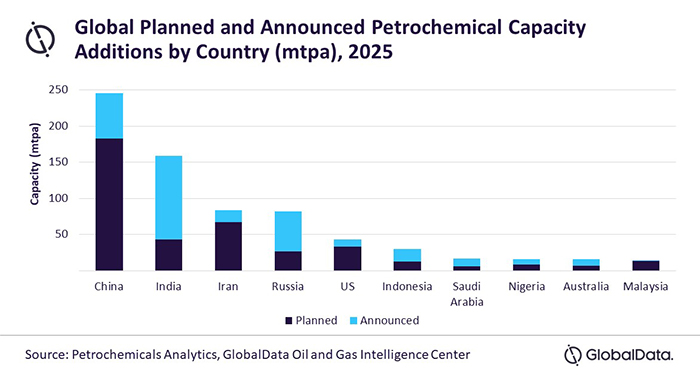

The global petrochemical capacity is poised to see a considerable growth by 2030. It is set to potentially increase from 2,214.9 million tons per annum (mtpa) in 2020 to 3,103.6 mtpa in 2030 registering a total growth of 40%. China is expected to account for 29% of the global petrochemical capacity additions by 2030, forecasts GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Petrochemicals Capacity and Capital Expenditure Outlook, 2021 – 2030 – Asia Leads Global Petrochemical Capacity Additions’, reveals that China will account for the highest capacity additions with a capacity of 245.5 mtpa by 2030. Major capacity additions will be from the Shandong Yulong Petrochemical Longkou Ethylene Plant 2 with a capacity of 5.2 mtpa by 2030.

Dayanand Kharade, Oil and Gas Analyst at GlobalData, says: “China will dominate the global petrochemicals market in the mid-term with both the biggest number of new projects and the largest absolute capacity expansion driven by economic growth. The country is forecast to account for 51% of the Asian capacity additions during the outlook period.”

GlobalData identifies India as the second highest country in terms of capacity additions, with a capacity of 158.4 mtpa by 2030. Major capacity additions will be from the Reliance Industries Jamnagar Styrene-Butadiene Rubber (SBR) Plant, with a capacity of 6.5 mtpa by 2030.

Iran will be the third highest country in terms of capacity additions, with capacity of 83.3 mtpa by 2030. Major capacity additions will be from the Kaveh Methanol Company Dayyer Methanol Plant with a capacity of 2.3 mtpa by 2030.

Reliance Industries Ltd, Haldia Petrochemicals Ltd, and China Petrochemical Corp will be the top three companies globally in terms of planned and announced capacity additions over the outlook period.

COMMENTS