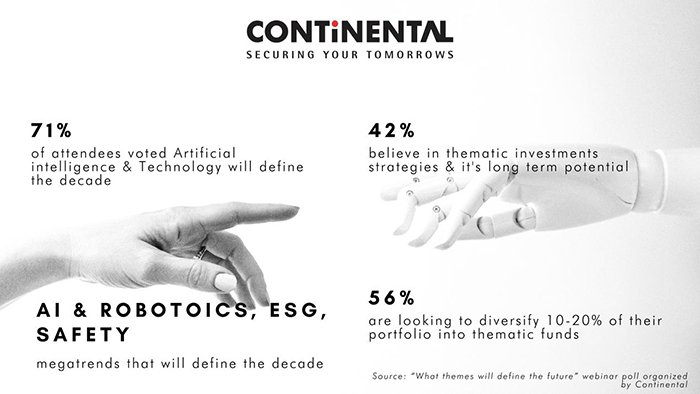

The Continental Group, a leading insurance intermediary and financial services solutions provider in the GCC region, unveils findings about the major investment trends that will dominate the market in the coming decade. According to the findings, 71 percent of the respondents agreed that new technology trends such as Artificial Intelligence, Robotics and associated services are the major trends that will dominate investments.

26 percent of the respondents opted for ESG impact investing while a small fraction of 3 percent opted for safety-related domains. Majority of the respondents unequivocally agreed on the long-term growth potential of thematic investments under equity and fixed income space.

According to The Continental Group, there has been a recent uptick in investment activity after a prolonged downturn due to the pandemic. The new wave is also accompanied by a renewed market outlook, increased focus on AI and robotics, and an accelerated shift towards thematic investments.

On the occasion of unveiling the findings, Neelam Verma, Vice President and Head of Investments, The Continental Group, said: “At The Continental Group, our focus has always been towards providing well-researched themes within equity and fixed income space to build our clients’ wealth, completely aligned within their risk tolerance. Our recently concluded webinar, ‘What Themes will Define the Decade: Harness the potential of thematic investment strategies for structural growth’, showcases our commitment towards achieving investors’ financial goals and objectives with the help of our experienced team of advisors with unwavering passion. As wle move towards the new normal, our clients can look forward to innovative thematic solutions and offerings to add to their portfolios.”

Esty Dwek, Head of Global Market Strategy, Natixis, said: “As opposed to conventional investment instruments, thematic equities and ESG-related funds proved to be more resilient against pandemic headwinds. This was a precursor to the broader shift towards mega-trends around investments in the areas of environment, water security, green cities, and AI; which have significant long-term relevance.”

Karen Kharmandarian, Senior Portfolio Manager, Thematics Asset Management, said: “As we gear up for the post-pandemic revival, this larger context was the perfect backdrop for the Continental Group to host a webinar on thematic investment strategies, and bring diverse ideas to the table. Such endeavours will help all our stakeholders to effectively navigate new challenges, and extract maximum value from the newly emerging digital investment classes.”

Other major findings also included:

- In the current investment climate, diversified approaches within specific risk bands can help build durable portfolios

- Just traditional bonds and equities mean that you may not get the type of returns you are hoping for

- ESG will find greater acceptance in general asset allocation

- Thematic investing can be an attractive source of alpha, but as per our observations, investors can be slow to recognize thematic drivers and may not unlock the power of a theme with long-term growth

- Explore investment avenues across the value chain of themes

- With the meteoric increase in connected devices – all generating more and more data – the technology theme holds promise, especially within the context of AI and robotics

The findings were based on the recent webinar discussion and a poll bringing leading voices in the financial industry together, to share their expertise, and demystify the market forces influencing post-pandemic investments. Neelam Verma, Vice President and Head of Investments, The Continental Group; Esty Dwek, Head of Global Market Strategy, Natixis; Karen Kharmandarian, Senior Portfolio Manager, Thematics Asset Management were the main speakers, and the session was moderated by Anselm Mendes, the Executive Director of Sales and Technology at The Continental Group.

As an initiative to create further financial awareness, The Continental Group will be hosting another webinar on ‘Investment Opportunities and Challenges in Asian markets’ in the near future.

COMMENTS